Net Zero Initiative for Energy

Guidance on the carbon accounting of renewable electricity purchases

Résumé exécutif

Depuis sa création, la Net Zero Initiative (NZI) vise à soutenir les entreprises dans leur contribution à la neutralité carbone collective de manière ambitieuse et compatible avec la science du climat.

Pour y parvenir, l'initiative vise à structurer le cadre de mesure, de ciblage et d'action climatique autour de trois piliers distincts : les émissions induites (pilier A), les émissions évitées (pilier B) et les émissions séquestrées (pilier C). Le secteur de l'électricité joue un rôle clé dans la décarbonisation globale de l'énergie et de nombreux secteurs qui en dépendent, tels que l'industrie et les transports. En outre, les entreprises sont tenues de démontrer leur capacité à réduire les émissions liées à leur consommation d'électricité, qui sont généralement comptabilisées dans le scope 2 de leur empreinte carbone.

Le présent rapport fournit des orientations sur la comptabilisation des achats d'électricité renouvelable dans les piliers A et B de la NZI. Il est divisé en deux parties :

- Partie 1 : MARCHÉ DE L'ÉLECTRICITÉ À FAIBLE ÉMISSION DE CARBONE ET SYSTÈMES DE COMPTABILISATION DU CARBONE

- Partie 2 : RECOMMANDATIONS POUR LA MODIFICATION DES RÈGLES COMPTABLES

PARTIE 1 - MARCHÉ DE L'ÉLECTRICITÉ À FAIBLE ÉMISSION DE CARBONE ET SYSTÈMES DE COMPTABILISATION DU CARBONE

Marchés de l'électricité et contrats d'approvisionnement

De nombreux systèmes de contrats d'approvisionnement en électricité ont été développés à travers le monde ces dernières années afin de permettre aux entreprises de « choisir » le type d'électricité qu'elles achètent. Étant donné que les réseaux électriques sont interconnectés au niveau régional ou national, il est rare que ces contrats d'approvisionnement reflètent un lien physique entre le producteur et le consommateur.

En particulier, les études sur l'impact des garanties d'origine (GO) sur les marchés de l'électricité indiquent que sans appariement horaire[1], leur impact est très faible, voire négligeable[2], et les données de suivi permettant de vérifier la cohérence temporelle sont généralement insuffisantes. De plus, les GO contribuent peu au financement de nouvelles infrastructures d'énergie renouvelable. En 2022, le prix moyen d'une GO en France était de 4,1 €/MWh[3], contre 63 €/MWh[4] pour le coût de production d'électricité renouvelable supplémentaire (principalement sol photovoltaïque au sol et éolien terrestre).

Limites de la comptabilisation actuelle des achats d'électricité renouvelable

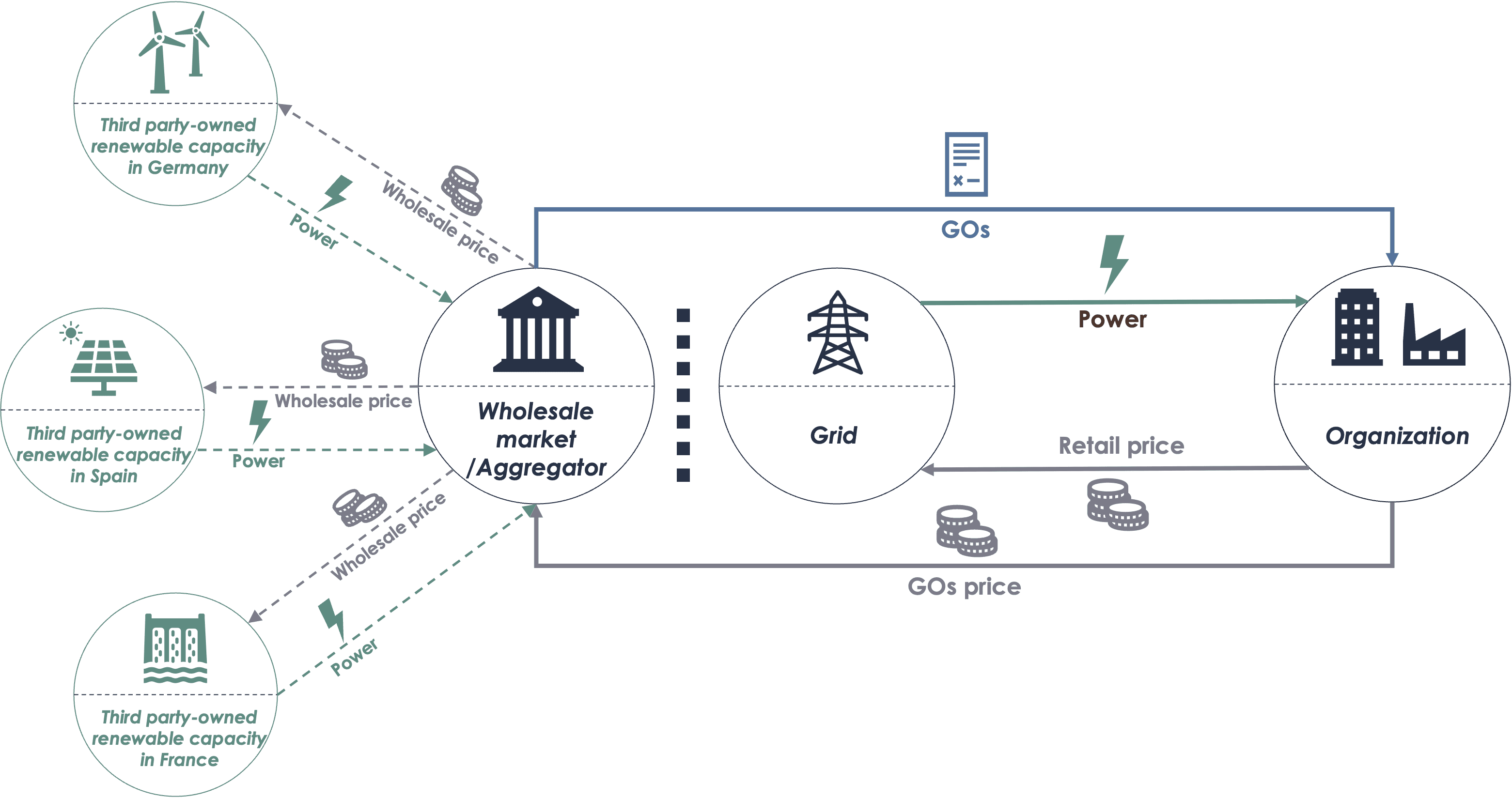

La comptabilisation basée sur le marché permet d'utiliser les facteurs d'émission de l'électricité renouvelable achetée avec un certificat, sans effet systématique sur la décarbonisation de l'électricité consommée. Par exemple, dans le système européen actuel, une organisation allemande qui consomme de l'électricité pendant une nuit d'hiver peut revendiquer de l'« électricité renouvelable » et des réductions d'émissions sur le marché, grâce à des garanties d'origine émises à partir de la production photovoltaïque d'une journée d'été en Espagne.

Cette incohérence spatiale et temporelle est non seulement susceptible de ralentir la décarbonisation réelle de l'électricité (en Allemagne dans l'exemple précédent), mais elle induit également les acheteurs en erreur quant à la nature de l'électricité consommée. De plus, ce mécanisme masque les efforts nécessaires pour rendre le réseau électrique plus flexible (capacité de stockage, adaptation de la demande) liés au développement des énergies renouvelables intermittentes[5]. La figure 1 ci-dessous illustre cette différence entre le raccordement physique d'une organisation connectée à un réseau alimenté par de l'électricité renouvelable et non renouvelable, et le raccordement financier au marché de gros avec des certificats renouvelables provenant de toute l'Europe.

Au niveau européen, le marché est inondé de Garanties d'Origine à bas prix où la production d'électricité renouvelable est facile et importante (énergie solaire en Espagne ou hydroélectrique en Norvège, par exemple). Cependant, les acteurs présents dans ces pays sont également susceptibles de revendiquer une électricité à faible intensité carbone pour cette même production en raison de la connexion physique qui les relie à ces capacités, en recourant de manière préférentielle à la comptabilisation basée sur la localisation, ce qui entraîne un risque de double comptage.

Besoin de nouvelles méthodes et de nouveaux critères dans les règles comptables

Dans ce contexte, le présent guide se concentre sur les questions suivantes : dans quelles conditions un contrat d'achat d'électricité contribue-t-il réellement à décarboner l'électricité dont dépend une organisation ? La comptabilisation actuelle du carbone peut-elle refléter cela ? Si ce n'est pas le cas, comment pourrait-elle évoluer pour y parvenir ?

Ce guide se concentre sur les principaux types de contrats d'électricité renouvelable qui existent, mais ne couvre pas les garanties d'origine ni aucun autre certificat pour l'électricité non renouvelable. Il s'agit toutefois d'une évolution intéressante des marchés des certificats, et leur impact sur la comptabilisation des émissions pourrait être développé à un stade ultérieur. Ce document présente des propositions méthodologiques pour la comptabilisation associée à ces contrats dans le cadre de la NZI. Ces propositions visent à refléter l'impact réel de ces différents contrats d'approvisionnement en énergie en termes d'émissions induites (pilier A) et d'émissions évitées (pilier B). En effet, ces types de contrats d'approvisionnement en électricité recouvrent des réalités différentes, avec un impact très variable sur la décarbonisation de l'électricité, que la comptabilisation actuelle du carbone ne permet pas de saisir.

PARTIE 2 - RECOMMANDATIONS DE MODIFICATION DES RÈGLES COMPTABLES

De nouveaux critères de comptabilisation du carbone sont donc introduits afin d'inciter les acteurs économiques à privilégier les contrats les plus vertueux en termes de décarbonisation de l'électricité. À travers ce document et ces recommandations, le cadre NZI vise à contribuer aux travaux en cours du GHG Protocol pour sa norme Corporate Standard, avec une comptabilisation rigoureuse et ambitieuse des achats d'énergies renouvelables, susceptible d'accélérer la décarbonisation du secteur électrique.

Critères de cohérence spatio-temporelle

Ce guide propose donc des critères ambitieux de cohérence spatio-temporelle entre la production et la consommation d'électricité, afin de stimuler le marché de l'électricité vers une plus grande transparence et une meilleure cohérence spatio-temporelle des achats d'électricité. Les principales propositions de ce guide concernent la comptabilisation basée sur le marché des GO et des contrats d'achat d'électricité pour le pilier A :

- Cohérence spatiale : les installations de l'acheteur et les installations renouvelables doivent être connectées à un réseau et limitées aux pays/États ou provinces limitrophes. Cette condition reflète le fait que, malgré les interconnexions entre les réseaux de différents pays, États ou provinces, la quantité d'électricité transférée d'un réseau à l'autre est souvent limitée, en particulier lorsque les réseaux ne sont pas adjacents. Le développement des interconnexions électriques est l'une des priorités énergétiques de l'Union européenne, mais il nécessite des infrastructures importantes. L'objectif de capacité d'interconnexion pour chaque pays (avec ses pays limitrophes) a été fixé à 10 % de sa capacité installée en 2020 et à 15 % en 2030[6], ce qui est loin d'un réseau électrique où les électrons traverseraient le continent aussi facilement que sur le marché.

- Cohérence temporelle : la consommation doit avoir lieu dans les 30 jours suivant la production de l'GO (rapprochement mensuel) et la comptabilisation de la réduction des émissions dépend du niveau de cohérence temporelle :

- 100 % des réductions d'émissions peuvent être comptabilisées avec un rapprochement horaire.

- 50 % des réductions d'émissions peuvent être comptabilisées avec un rapprochement quotidien.

- 25 % des réductions d'émissions peuvent être comptabilisées avec un rapprochement mensuel.

- Aucune réduction ne peut être comptabilisée si la cohérence est supérieure à un mois.

Transparence et suivi précis des marchés de l'électricité

Certaines de ces conditions, en particulier l'alignement horaire entre la consommation d'électricité et la délivrance des certificats renouvelables (appelé « cohérence temporelle » dans le présent guide), posent des défis techniques pour la réduction des émissions du pilier A, étant donné que les marchés de l'énergie ne permettent pas actuellement un suivi précis.

À terme, des conditions strictes de correspondance horaire devraient être établies pour la comptabilisation des GO dans quelques années. Toutefois, la correspondance quotidienne et mensuelle peut temporairement permettre de comptabiliser une réduction partielle des émissions liées à la consommation d'électricité. Ces conditions souples restent volontairement ambitieuses, car des lignes directrices strictes devraient favoriser une évolution rapide des marchés et des organisations.

Cette phase de transition a été conçue pour encourager les acteurs à améliorer leur cohérence temporelle, jusqu'à ce que les conditions permettent une correspondance horaire plus réalisable. En outre, les règles comptables proposées visent à soutenir les initiatives en cours pour développer des systèmes d'information au niveau de granularité requis. De plus, le développement d'un système de suivi précis et harmonisé du facteur d'émission du mix résiduel est également essentiel pour rendre la comptabilité basée sur le marché fiable et incitative pour la décarbonisation.