Ensuring supplies of raw materials and securing value chains within the dual context of Russia’s war on Ukraine and the imperative to decarbonize our economy

Summary of the article

- The COVID-19 health crisis and the war in Ukraine have exposed the dependency of our economies on raw material resources.

- While the decarbonization roadmap for our economies involves reducing our dependency on fossil fuels, it will also increase our requirements in metals, necessary for certain “decarbonizing” technologies such as renewable energies and batteries.

- The value chains for these metals are currently very strongly dominated by Asia.

- If Europe is to remain in control of its destiny where the low-carbon transition is concerned, it will have to adopt a concerted strategy that will allow it to aim for a form of resilience with regard to essential raw materials. The current geopolitical context only adds to this urgency. Europe can draw on the following four levers:

- energy sufficiency;

- resource circularity;

- the structuring of sustainable value chains;

- the creation of a new relationship to resources, seen as a common good for humanity, and of adequate governance of these resources.

Introduction

In France and in Europe, the COVID-19 pandemic has highlighted a strong external dependency on products now considered vital, notably masks, gloves and vaccines. The war in Ukraine and the resulting dire humanitarian crisis have brought to light yet another of Europe’s dependencies, namely on the supply of raw materials, both fossil fuels and metals. The economic repercussions of the soaring prices of foodstuffs, metals and hydrocarbons exported by Russia and Ukraine demonstrate the fragility of our globalized value chains, and illustrate the importance of supply choices in the functioning of our economies and industries. While the low-carbon transition will drastically increase requirements in critical metals, it invites us to rethink our value chains to remain in control of our destiny.

A. The transition to a low-carbon economy could significantly increase global demand for raw materials.

Within the framework of the Fit-for-55 climate change package, the European Union has set targets to reduce its greenhouse gas emissions by 55% by 2030 (relative to 1990) and concerning all sectors of the economy. The low-carbon transformation will drastically increase the demand for specific mineral resources that play a crucial role in certain decarbonization technologies.

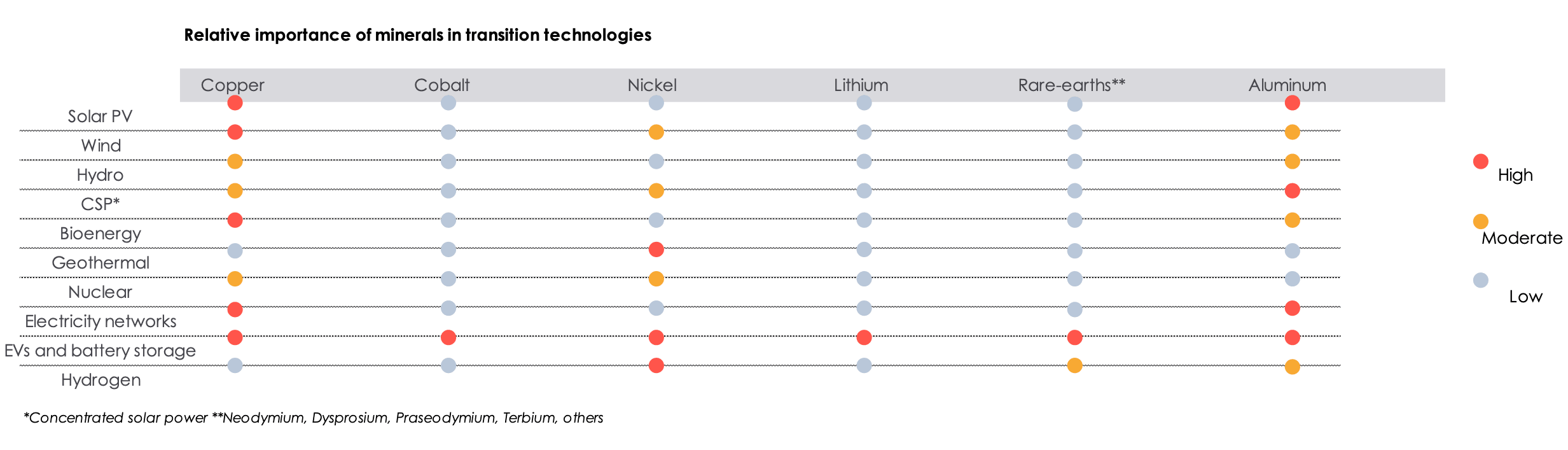

As summarized in the table below, lithium, nickel, cobalt and graphite are essential for the construction of batteries for electric vehicles, rare-earth elements[1] for the permanent magnets used in wind turbines and photovoltaic motors, and significant amounts of copper and aluminum for electricity networks.

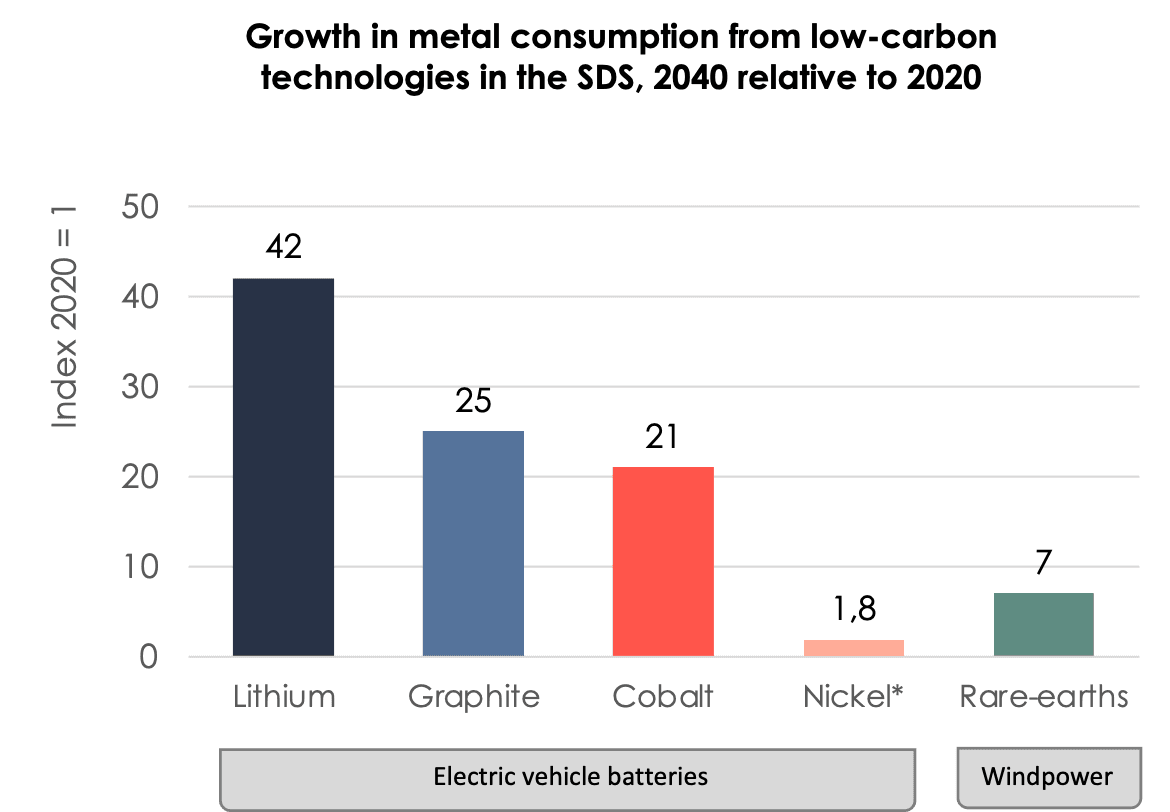

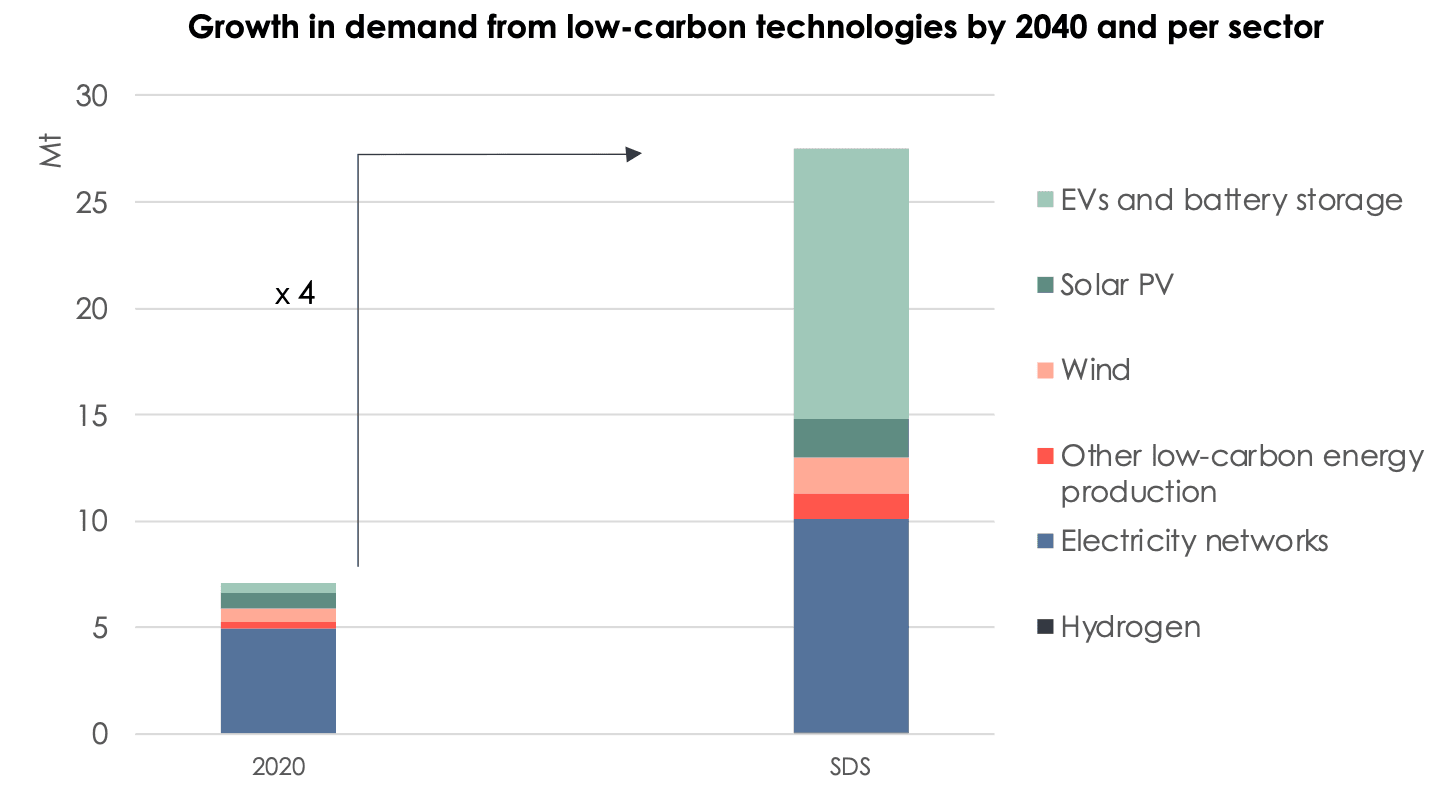

To understand the orders of magnitude involved, the Sustainable Development Scenario (SDS) of the International Energy Agency (IEA) forecasts that the global consumption of metals and minerals[2] used in decarbonization technologies will have increased at least by a factor of 4 by 2040. Today, global demand for nickel and cobalt is primarily driven by non-transition related consumption. However, the continued growth of the electric vehicle battery market alone is expected to cause, by 2040, a 40-fold increase in lithium consumption and a 21-fold increase in cobalt consumption, while the total demand for nickel will double. The consumption of rare-earths, related to the wind energy sector, is expected to increase sevenfold.

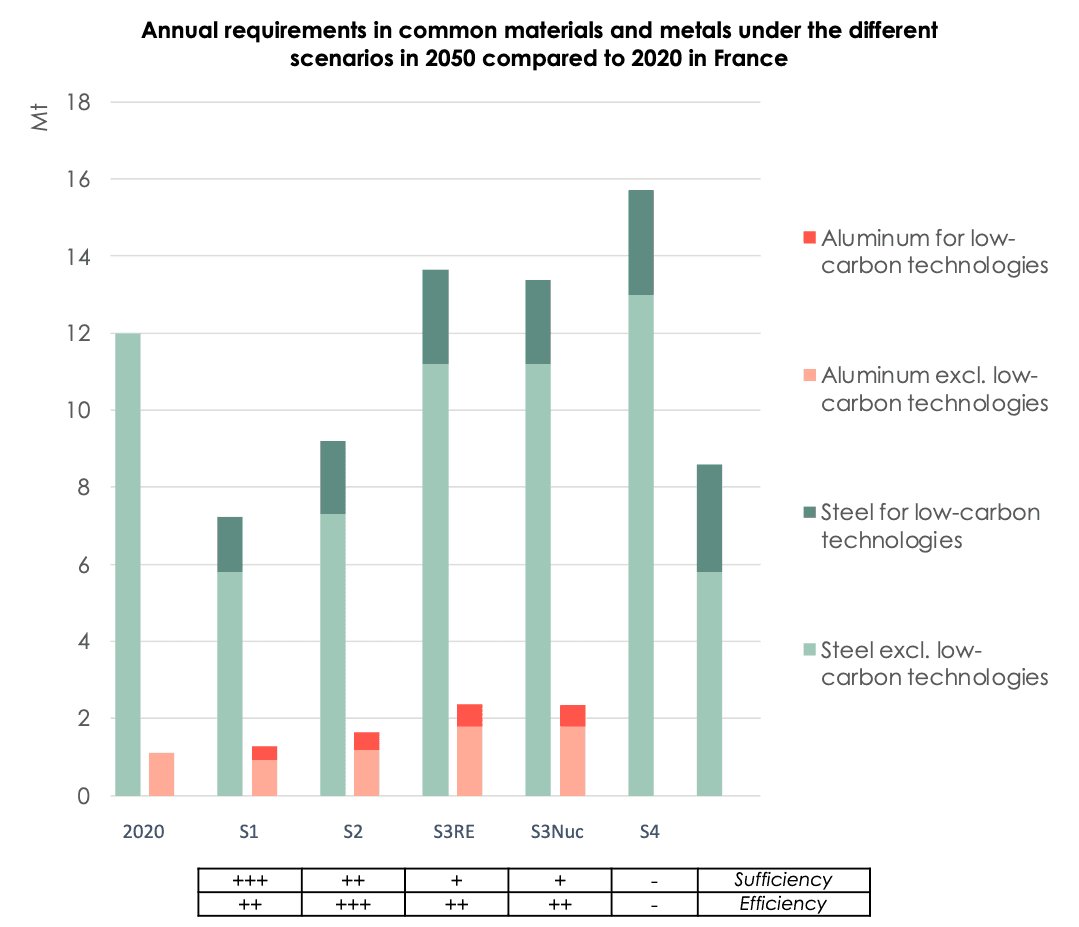

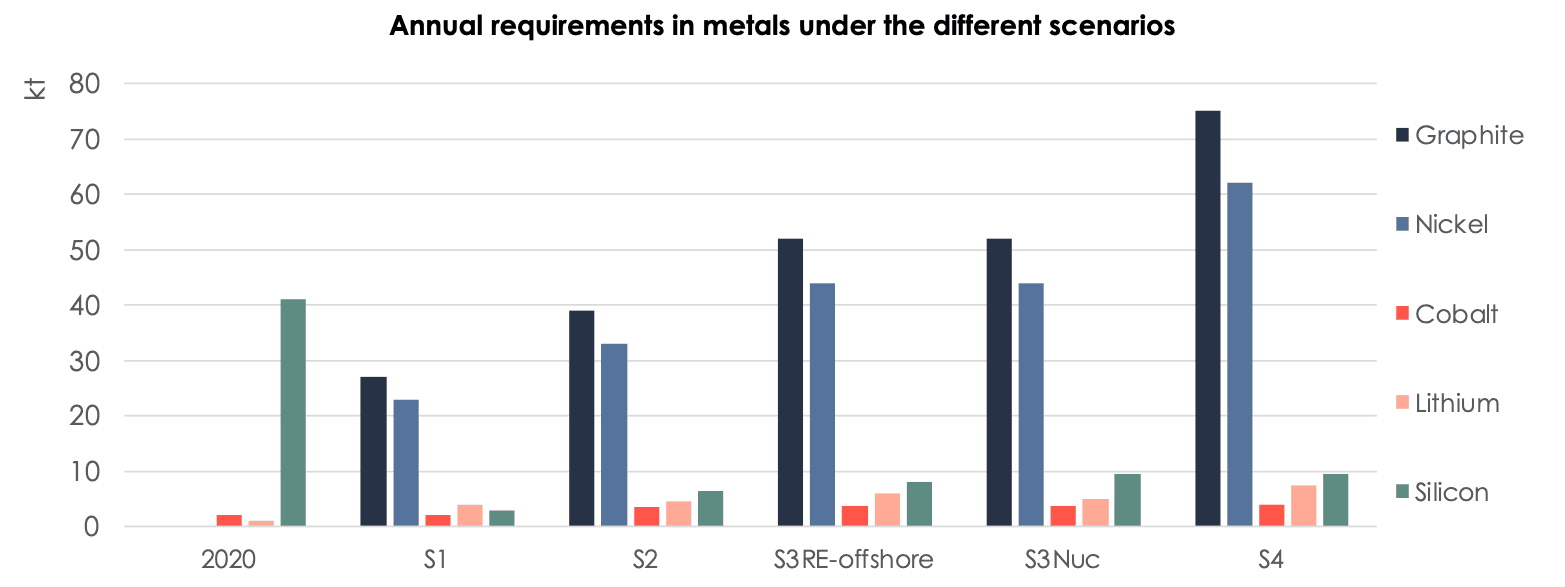

In France, the scenarios developed by ADEME (Agency for Ecological Transition) – with decreasing energy sufficiency and increasing technology from S1 to S4 – indicate that by 2050 the consumption of lithium is expected to be multiplied by a factor of 5 to 7 with respect to its current level, and that of cobalt by a factor of 1 to 2. In each of these scenarios, the quantity of steel, aluminum and copper, primarily driven by the demand for new vehicles (representing 60% of total demand for steel, 90% for aluminum and 75% for copper) follows the evolution of the sales volume, which varies from 1.5 to 3 million in scenarios S1 to S4, compared to 2.5 million in 2020[3].

B. The current structuring of globally fragmented value chains is giving rise to a new geopolitics of resources.

The war in Ukraine has profoundly destabilized our economies through its impact on global supply chains related to the soaring prices of raw materials, notably wheat, corn, gas and oil, of which the two warring countries are among the main exporters. Metals and gases such as aluminum, nickel, palladium, titanium, krypton and neon have also reached record high prices. These metals and gases have the specificity of being essential to transition technologies. They are used in the manufacturing processes of electric vehicles (EV), solar PV, wind power, and the production of semiconductors, the latter being found in all smartphones, cars and computers, and without which no digital product is possible.

Some 90% of neon gas comes from Ukraine.

Russia produces:

- 40% of palladium (semiconductors and catalytic converters);

- 10% of platinum (diesel engines and fuel cells for hydrogen vehicles);

- 6% of the world’s aluminum.

Regarding the latter, France imports 50% of its requirements, a third of which from Russia. Dependency is even greater for alumina, used in the production of primary aluminum, with France importing 80% of its requirements from Russian giant Rusal[4].

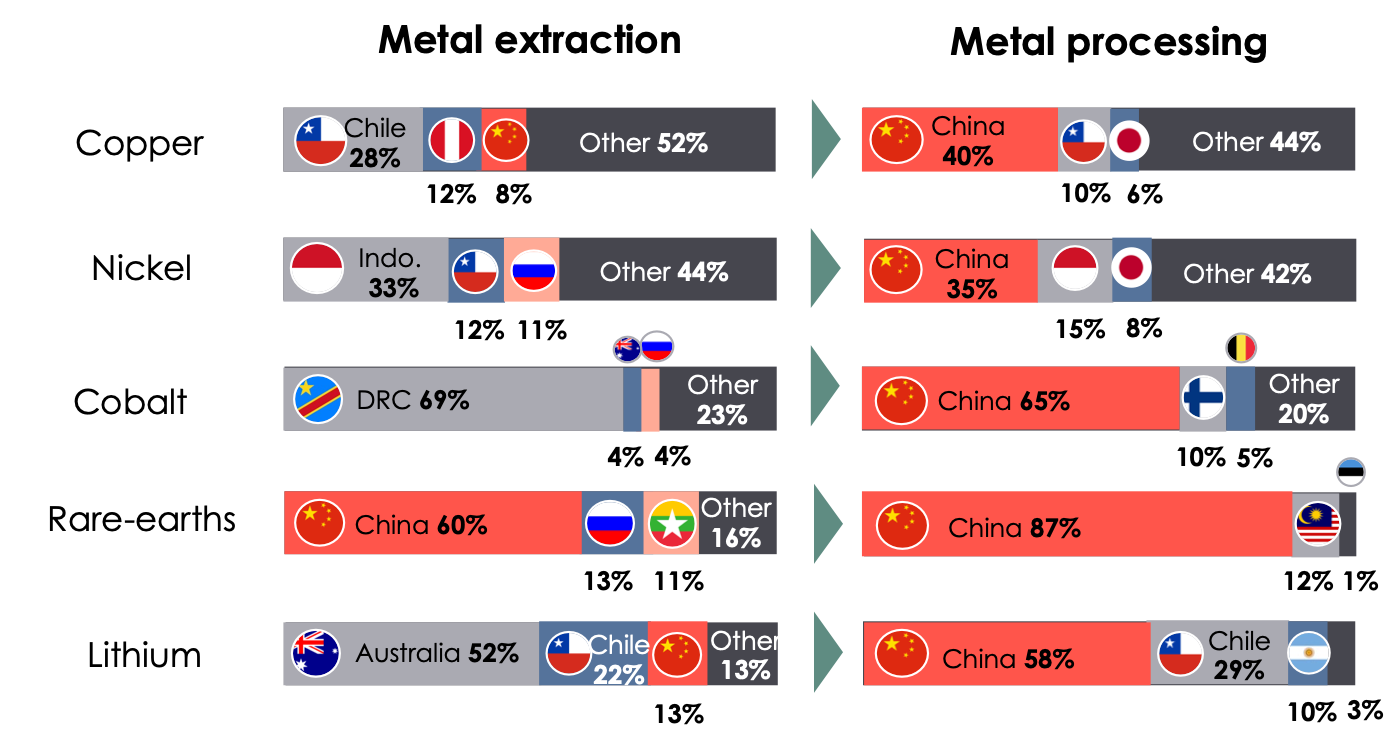

These figures illustrate a global reality: mineral resources, their production and refining are highly concentrated from both geographical and capital-intensive perspectives. Modern manufacturing processes therefore require the orchestration of a wide variety of non-substitutable inputs coming from a very small number of countries, of which, incidentally, China boasts the lion’s share.

It is clear that the European Union is in a position of almost total dependency for the supply of its raw materials, particularly those that are now essential to its stated ambition concerning the reduction of its greenhouse gas emissions.

A raw material is considered to be critical when it is both of great economic importance – essential for industrial sectors that create added value and jobs, and with no immediate substitute – and when there is a high risk of supply shortages. The European Commission has drawn up a list of 30 critical raw materials, of which it produces only 3%, and of which more than 50% are imported from China[5]. The EU is only present in niche markets for battery and component production.

Achieving global carbon neutrality by 2050 implies eliminating the use of fossil fuels over the next three decades. Once the energy consumption reductions related to sufficiency and efficiency efforts are integrated, the necessary residual fraction of energy consumed for human activities will have to be decarbonized.

This will shift the current competition for access to fossil fuels to those metals that are essential for decarbonizing technologies, which run on low-carbon energy.

Mineral resources are thus joining hydrocarbons as a major geopolitical issue. With States positioning themselves as potential rivals in obtaining critical raw materials, some are developing a logic of self-sufficiency or of reduced dependency in order to secure their supply.

Strategies for economic sovereignty have thus emerged in Russia following the 2014 sanctions related to the annexation of Crimea, in India with the “Make in India” government initiative, and in China with the “Made in China 2025” national strategic plan. China represents a singular case on the global chessboard of access to resources. Indeed, Beijing currently produces 86% of rare-earths, the result of a strategy implemented several decades ago. To ensure its industrial independence, it has organized a move upmarket and developed vertically integrated companies, allowing it to control key links in the value chain for these metals. Given its dominant position, it has not hesitated to impose price distortions through firstly reductions in export quotas in 2011 followed by massive increases in its domestic consumption, thereby maintaining de facto pressure on its importing customers, the foremost of which being the United States and Europe.

C. The low-carbon transition requires Europe to adopt a concerted strategy that will allow it to aim for a form of resilience with regard to essential raw materials. This will ensure it remains in control of its own destiny. The current geopolitical context only adds to this urgency.

Four complementary levers are available to Europe to both achieve this resilience[6] and to reconcile the requirements for raw materials induced by human activities, on the one hand, with planetary limits on the other:

- Energy sufficiency, i.e. the massive reduction of consumption requirements, as a priority and as soon as possible.

- An increase in resource circularity and in recycling.

- The structuring of sustainable value chains for those requirements not covered by the first two levers.

- Finally, a possible radical change in approach to resources, considering them as common goods and not as conventional material goods that can be appropriated by only a fraction of the human population.

1. The first lever therefore consists in reducing requirements in raw materials by reconsidering our consumption in the light of redesigned requirements that target only what is necessary and not the superfluous.

Sufficiency is thus the first and absolutely essential step in limiting our dependency on these productions. It invites us to reassess what in our consumption has value, and what we could do without. It also opens up a major avenue for innovation with a view to replacing, to the greatest extent possible, current raw materials with low-carbon and less critical raw materials.

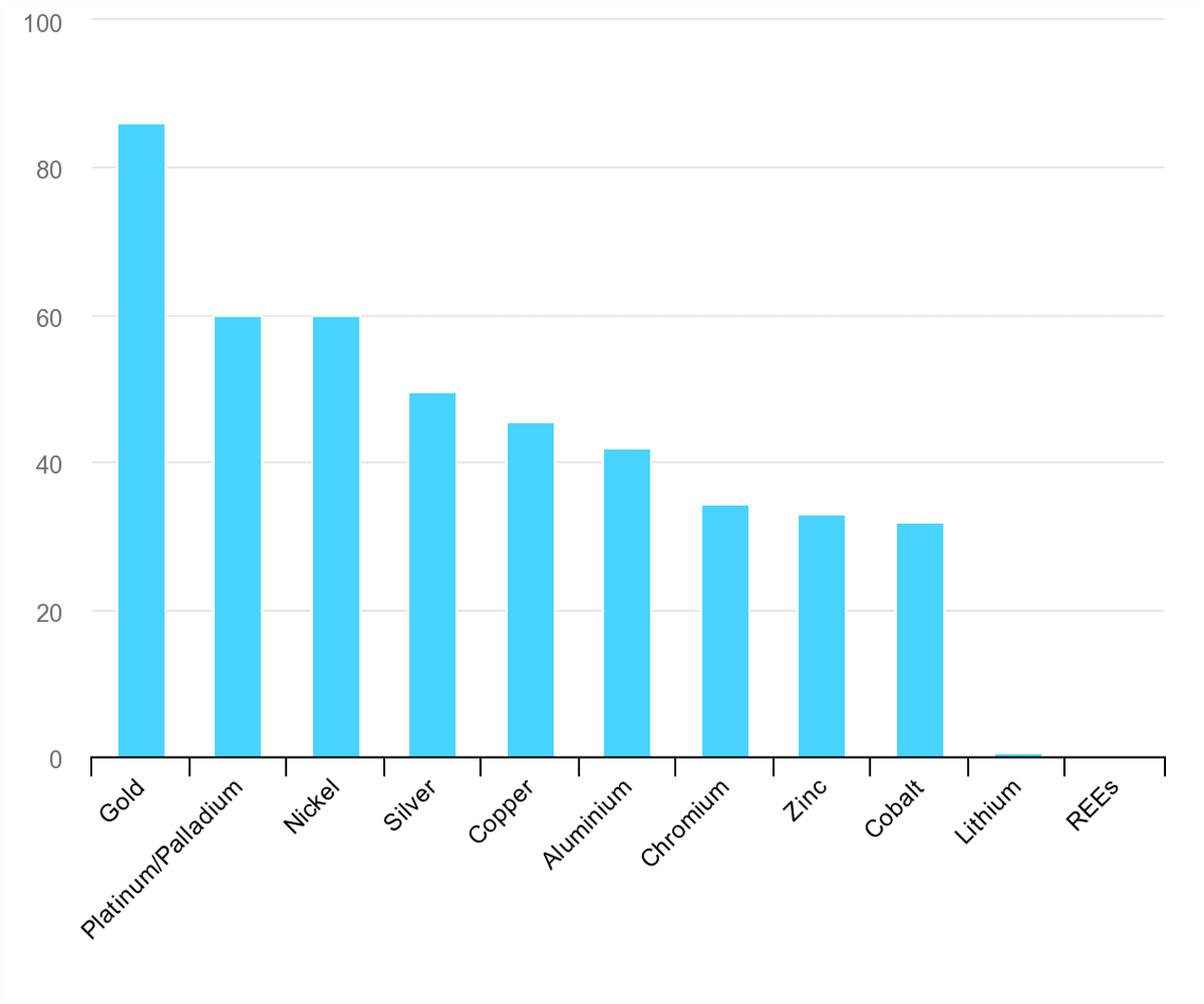

2. The second lever consists in developing an ultra-efficient use of resources already present in the territories by optimizing recycling capacities, which involves major investments to accelerate the circular economy.

Recycling in the battery industry is a key issue in this respect. Reflecting the urgency of the situation, the European regulation on the battery industry currently being studied has raised the recovery rates and collection thresholds for metals.

Generally speaking, improving our recycling capacity will depend on our ability to optimize collection. It will also depend on the ingenuity of industrialists in improving processes, as well as on French and European regulations to increase the cost of carbon-based products. The aim of the latter would be to make the use of recycled materials less expensive than that of virgin raw materials.

“Collection and logistics costs represent a significant part of the cost of battery recycling. Today, the battery recycling value chain does not yet exist in Europe. The business model for this industry has yet to be defined, but in any case, the volumes to be recycled will be very high and it is vital to have a competitive process in place to recycle used batteries in the most cost-effective manner and with the lowest CO2 emissions possible.”

3. The third lever lies in the structuring of sustainable value chains for requirements not covered by the first two levers.

When our requirements, even reduced, exceed the primary or secondary resources available on our territory, control of the next stages of the value chain (refining, precursors of finished products, finished products) will be crucial for Europe. These activities, located on its territory, will have to be decarbonized, which will generate higher investment costs. Market rules to protect these investments will have to be implemented, the EU’s Carbon Border Adjustment Mechanism (CBAM) that is currently under discussion representing a first step in this direction.

“How can we develop a competitive European battery industry? If battery production costs in Europe were to prove higher than in China, would consumers choose to pay more for a French car? Today in Europe, consumers do not know where their battery comes from or under what conditions it was manufactured. It is important to develop transparency in the battery value chain.”

With regard to the extraction of raw materials not present in Europe, it is imperative to implement the EU’s Raw Materials Diplomacy. Following the example of Japan and its strategy to secure its supplies, the trio of actors below would have to operate in a planned manner to orchestrate this European strategy:

- the public authorities (the European Commission, for example, under a mandate that could be inspired by that implemented for the centralized purchase of vaccines during the COVID-19 health crisis);

- the sector’s industrialists;

- the relevant financing actors.

This triumvirate would be joined by representatives of civil society. The Varin report[7] takes a modest step in this direction with the idea of investment funds in strategic metals for the energy transition, but seen from a strictly French perspective and omitting the participation of civil society.

Moreover, if this approach merely replicates a historical dynamic of appropriating materials from there for our requirements here, it will simply perpetuate the resource curse[8] or Dutch disease. The relationship between producing and consuming countries should not be a strictly commercial relationship, but rather a genuine co-development agreement, particularly when these countries are in a notable situation of underdevelopment:

- guaranteed access for producing countries to the fraction of the extracted raw material intended to meet their domestic requirements;

- assistance by consuming countries to develop a processing industry for the extracted raw material in the producing country, enabling maximization of the value captured locally, and this assistance being associated with long-term agreements ensuring volumes of raw materials for the consuming countries;

- provision by consuming countries of decarbonizing technologies, enabling producing countries to follow the most low-carbon development path possible.

4. The fourth lever poses in a more fundamental way the question of how to build a serene and sustainable relationship between requirements in raw materials for our human activities and the planet’s physical limits.

The competition to acquire more and more resources, in order to continually produce more and thereby vie for domination of the economic playing field, is already (and will be increasingly harshly) confronted with the finiteness of these resources and, more broadly, with the physical limits of the only spacecraft housing humanity: the Earth.

After having reduced this requirement in resources to what is strictly necessary, by means of energy sufficiency and resource circularity, wouldn’t the next step involve representing these resources as a common good? By definition, this good is necessary for all since it allows for a decent standard of living for the whole of humanity. It should therefore be managed in a concerted manner and not be appropriated by a small number of individuals to the dual detriment of the others: in a zero-sum game, when some take the biggest slice of the cake, less is left for the others, who will also suffer all the more from the environmental consequences of this overexploitation of resources.

This idea of coordinated and equitable governance at the international level, guaranteeing fair and sustainable access to common goods resources, may appear somewhat utopian today. But if we want to avoid a Mad Max-like dystopian future, this could become a matter of course within the next few years given the probable succession of crises that will result from the confrontation of our economies with the limits of our planet.

Contact us

Contact us about any question you have about Carbone 4, or for a request for specific assistance.